How To Calculate Profitability Ratio For Banks

The formula to calculate Current Ratio is as given below. 4 Financial Leverage.

Operating Profit Margin Learn To Calculate Operating Profit Margin

Banks do not give any interest on current account deposits and the interest on a savings account is usually very low between 3-4.

How to calculate profitability ratio for banks. Many banks and other lending organizations use statistical procedures to analyze firms financial ratios and on the basis of their analyses classify companies according to their probability of getting into financial distress. Operating Profit Margin Operating Profit Margin Operating Profit Margin is the profitability ratio which is used to determine the percentage of the profit which the company generates from its operations before deducting the taxes and the interest and is calculated by. Profitability ratio analysis is useful but analysts should be aware of these problems.

Moreover The creditorsbanks and other lending institutions are concerned with the liquidity or the ability to pay interest and redeem loan within a specified period. In a rating or stock analyst report you will find a myriad of ratios. Cost of goods sold COGS refer to the inventory costs of those goods a business has sold during a particular period.

This ratio is relevant for all industries. The capacity to make a profit. It is a profitability ratio that measures earnings a company is generating before taxes interest depreciation and amortization.

The BEP ratio compares earnings before income and taxes to total assets. Read more ratio captures the impact of all obligation both interest-bearing and non-interest bearing. The other ratio used in profitability analysis is the return ratio.

3 Operation Profit Margin. Watch the video below on Everything you want to know about CASA Ratio. Its used to calculate the gross profit margin.

This is a solvency ratio which indicates a firms ability to pay its long-term debts. Return on assets return on equity and return on invested capital. Moreover high low ratio implies high low fixed business investment cost respectively.

As calculated above the net profit margin is 1862. You can calculate three types of ratios from the balance sheet. Express as a ratio the capital requirements are based on the weighted risk of the banks different assets.

Cost of Goods Sold. Profitability 9310 50000 1862. Banks may make investments or cut costs to respond to the competitive environment.

This guide has examples and a downloadable template. The debt to equity ratio also provides information on the capital structure of a business the extent to which a firms capital is financed through debt. EBITDA margin EBITDA Margin EBITDA margin EBITDA Revenue.

CASA ratio of a bank is the ratio of deposits in current and savings accounts compared to its total deposits. Adequately capitalized banks have a tier 1 capital-to-risk-weighted assets. Ratio analysis refers to a method of analyzing a companys liquidity operational efficiency and profitability by comparing line items on its financial statements.

Extreme cost-cutting can improve a banks efficiency ratio but those cuts may have an impact on future profitability customer satisfaction regulatory compliance and other aspects of the business. Likewise banks also use various ratios to measure the financial health of a company. Current Ratio Current Asset Current Liabilities.

Solvency cash or equivalents to pay debts. It represents the returns the company generated for its investors or shareholders. The Financial Leverage Financial Leverage Financial Leverage Ratio measures the impact of debt on the Companys overall profitability.

BEP EBIT Total Assets. Liquidity turn assets into cash. The lower the positive ratio is the more solvent the business.

A financial ratio is an integral part of the financial analysis of the company. There are three types of return ratios used in profitability ratio analysis. The ratios calculated from a companys balance sheet are used to determine its liquidity solvency and profitability.

Profitability Ratio Definition Formula Guide To Profitability Analysis

Profitability Ratios Accounting Play

Financial Ratios Analysis Plan Projections

Ratio Analysis Formula Calculator Example With Excel Template

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Accounting Ratios Example Explanation With Excel Template

Profitability Ratio Definition Formula Guide To Profitability Analysis

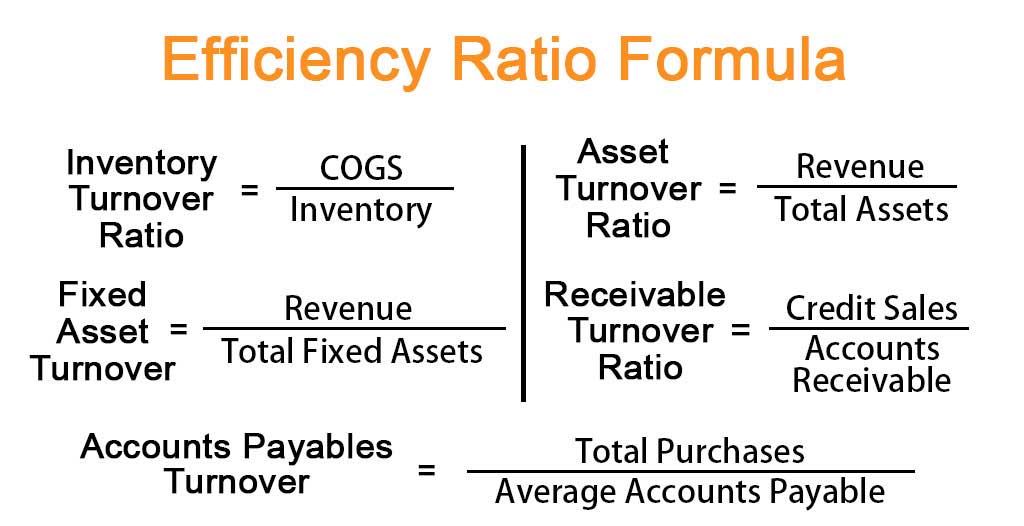

Efficiency Ratio Formula Examples With Excel Template

Profitability Ratio Definition Formula Guide To Profitability Analysis

How To Calculate Profitability Ratios For Banks Fox Business

Advantages And Disadvantages Of Profitability Ratios Efm

The 3 Main Profitability Ratios Used With Average Industry Profitability Stats

Profitability Ratio Definition Formula Guide To Profitability Analysis

Net Profit Margin Ratio Define Formula Calculate Interpret Compare

Profitability Ratios Types Margin Return Ratios Formula Example

Profitability Ratio Definition Formula Guide To Profitability Analysis

Gross Profit Margin Define Calculate Use Interpretation Of Higher Lower

Profitability Ratio Definition Formula Guide To Profitability Analysis

Download Ratio Analysis Excel Template Exceldatapro

Posting Komentar untuk "How To Calculate Profitability Ratio For Banks"